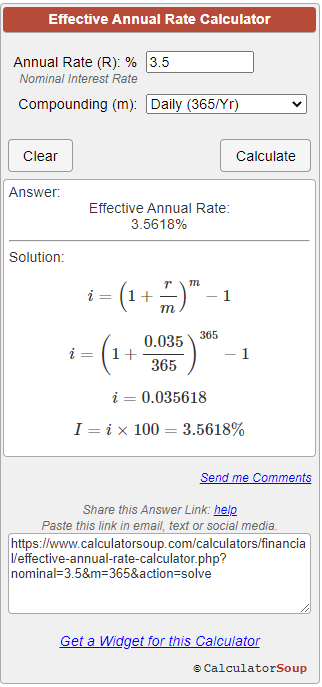

Calculator Soup Net Present Value

Excel offers two functions for calculating net present value. The net present value is the sum of present values of money in different future points in time.

Four Investment Concepts I Wish I Knew Earlier By Dr Ming Datadriveninvestor

Let us consider that 1000 is initially invested at a rate of 4 for 2 years.

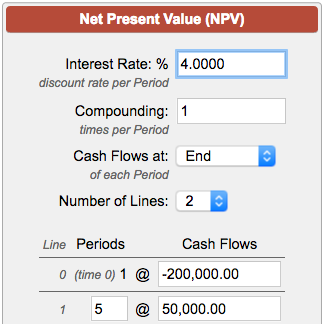

Calculator soup net present value. Code to add this calci to your website. Use this Online net present value calculator to calculate the NPV of cash inflows and cash outflows. The two functions use the same math formula shown above but save an analyst the time for calculating it in long form.

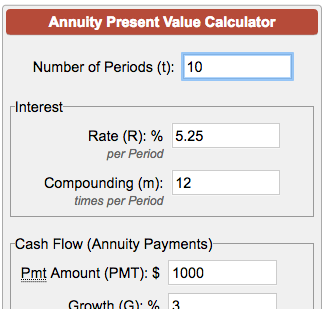

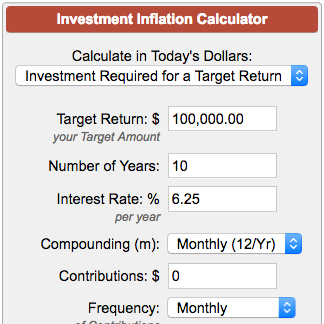

Because the time-value of money dictates that money is worth more now than it is in the future the value of a project is not simply the sum of all future cash flows. Since the future revenues must be adjusted for its discount rate the value of each year of future revenue must be discounted. A popular concept in finance is the idea of net present value.

Net Present Value Calculation Steps for PMP Exam. While its possible to calculate the NPV by hand the best approach is to use excel as it will automate the process for us. Calculate Net Present Value.

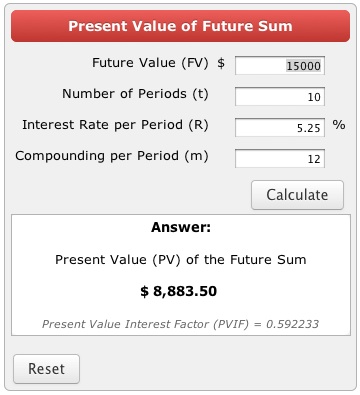

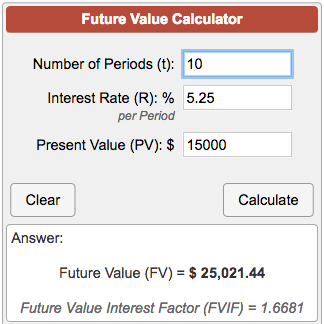

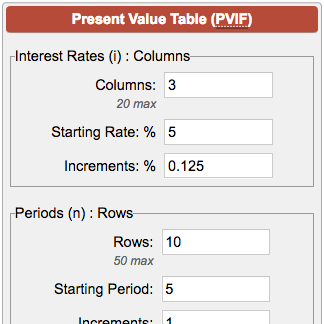

The Net Present Value is difficult to calculate by hand since the formula is very complex. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. Finds the present value PV of future cash flows that start at the end or beginning of the first period.

You can also sometimes estimate present value with The Rule of 72. Present value 50 1 101 Present value 50 1101. Present value is compound interest in reverse.

Where C 0 Initial Investment Amount C i Cash Flow T No. Similar to Excel function NPV. This calculation sums up the total of all adjusted cash flows accounting for inflow and outflow for the number of periods you define and the cost of the initial investment.

If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula. This equation is comparable to the underlying time value of money equations in Excel. Where in the above formula.

Assume there is no salvage value at the end of the project and the required rate of return is 8. Among other places its used in the theory of stock valuation. The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates.

Received today after subtracting the initial investment. Net present value NPV is an estimate of what the sum of all future cash flows would be worth if they were. The NPV of the project is calculated as follows.

The formula for NPV looks like this. Finding the amount you would need to invest today in order to have a specified balance in the future. Moreover NPV project selection criteria falls under the classification of benefit measurement method.

So the formula for calculating IRR is same as NPV. N positive integer. Where NPV value is equal to zero.

In this tutorial you will learn to calculate Net Present Value or NPV in ExcelIn this tutorial you will learn to calculate Net Present Value or NPV in. Next perform the full calculation with the initial investment. Managers find the NPV by calculating the present value PV of the total revenues and costs of a project.

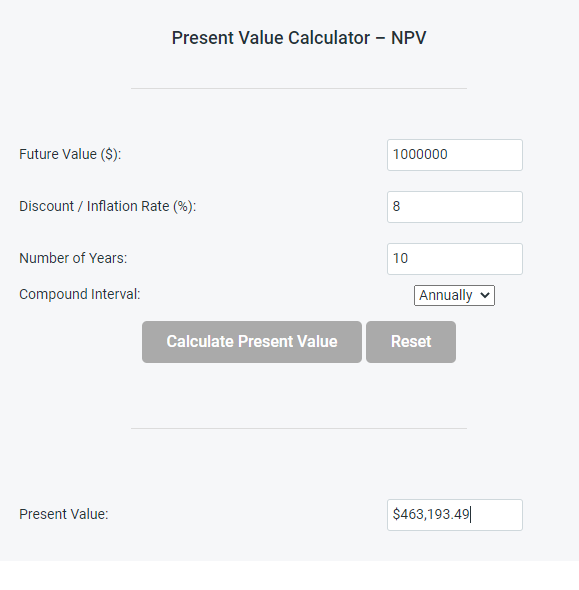

Where r is the discount rate and t is the number of cash flow periods C 0 is the initial investment while C t is the return during period tFor example with a period of 10 years an initial investment of 1000000 and a discount rate of 8 average. Estimating future net cash flows setting the interest rate for your NPV calculations computing the NPV of these cash. N P V 5 0 0 1 0.

0 8 1 3 0 0 1 0. Those future cash flows must be discounted because the money earned in the future is worth less. See How Finance Works for the present value formula.

Further NPV analysis uses discounted cash flow technique to assess project profitability. Net Present Value Analysis is a financial cash flow analysis technique that helps in project selection. N total number of periods.

C cash flow. Present Value Formula and Calculator. Net present value NPV is the present value of all future cash flows of a project.

A key factor in calculating the crossover rate is the net present value or NPV. IRR or internal rate of return is calculated in terms of NPV or net present value. The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money.

Net Present Value is a frequently used financial calculation used in the business world to define the current value of cash inflows produced by a project asset product or other investment activities after subtracting the associated costs. Net Present Value Definition. The regular NPV function NPV assumes that all cash flows in a series occur at regular intervals ie years quarters month and doesnt allow.

Calculate the net present value of uneven or even cash flows.

Net Present Value Case Interview Framework Management Consulted

Compound Interest Present Value Calculator Angkoo

Module Five Finance Based Skills Mathematics Pathways University Of Tasmania

Four Investment Concepts I Wish I Knew Earlier By Dr Ming Datadriveninvestor

Four Investment Concepts I Wish I Knew Earlier By Dr Ming Datadriveninvestor

Introduction To Quiz Economics Of Wind Energy Coursera L Pdf Net Present Value Present Value

Solved 1 You Are Given The Following Time Line Cfs Are At The End Of The Year Years 0 1 2 Cf Ss 3 4 0 5 0 On Gt 0 0 100 100 This Is A Perpe Course Hero

10 Min Npv Net Present Value Present Value Calculation Npv Explained Investing Finance Net

How To Calculate Present Value Annuity Factor Using Calculator

Four Investment Concepts I Wish I Knew Earlier By Dr Ming Datadriveninvestor

Investment Inflation Calculator

Solved 1 You Are Given The Following Time Line Cfs Are At The End Of The Year Years 0 1 2 Cf Ss 3 4 0 5 0 On Gt 0 0 100 100 This Is A Perpe Course Hero

Solved 1 You Are Given The Following Time Line Cfs Are At The End Of The Year Years 0 1 2 Cf Ss 3 4 0 5 0 On Gt 0 0 100 100 This Is A Perpe Course Hero

Compound Interest Present Value Calculator Angkoo

Introduction To Quiz Economics Of Wind Energy Coursera L Pdf Net Present Value Present Value

Post a Comment for "Calculator Soup Net Present Value"